Since they proliferated in the late 1990s, auctions have helped transform the coffee industry. These platforms facilitate the global exchange of quality lots, connect producers with buyers from all over the world, and facilitate price discovery mechanisms for different origins. As such, they have democratised green coffee trade and redefined perceptions of quality.

Over the last decade, as the coffee industry has become more globalised, there has been a fundamental shift in the green coffee auction model. Virtual events have boomed in popularity, buyers are increasingly willing to pay record prices, and market demand has become more niche. Auction formats no longer focus solely on single countries; they now include producers from a number of different regions and origins.

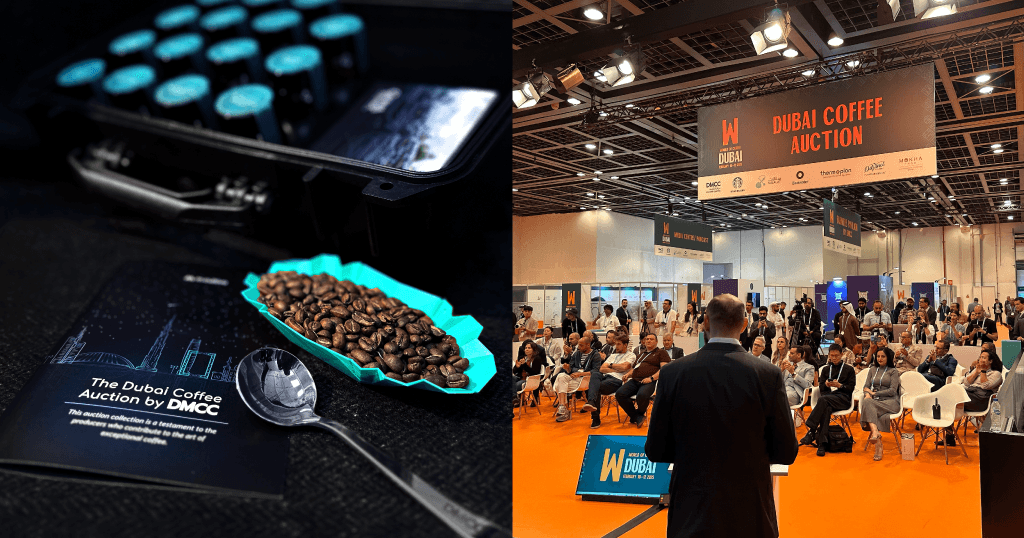

The 2025 Dubai Coffee Auction signifies this transformation, attracting an incredible bid of US $10,020/kg for a Panamanian Gesha. It also broke three records for Hawaiian, Bolivian, and Ethiopian coffees, showcasing the diversity and quality of specialty coffee worldwide.

As auctions continue to attract both international buyers and producers, the dynamics of green coffee trading will continue to shift, allowing producers to build global brands. To find out more, I spoke to David Paparelli, the CEO of M-Cultivo, Maria Olano, a senior trader at the Colombian Coffee Growers Federation, and several coffee producers.

You may also like our article on why coffee auctions have become more international.

How green coffee auctions have evolved from traditional models

Dating back centuries, auctions have long facilitated the sale of green coffee. However, the auction model as we know it today was developed in the 1990s. Modern auction formats identify exceptional quality lots, improve market access for producers, and attract premiums above the market average.

Today, there are a number of coffee auctions held worldwide, organised by associations and other entities that represent producers in their respective countries. These include online editions, which help lower barriers to entry for smaller-sized roasters and smallholder producers.

For years, national auctions dominated the coffee industry. They served as important platforms for drawing attention to the quality of different origins and giving buyers access to these coffees.

Although they certainly paved the way for more diverse auction models, country-by-country formats can be limited in terms of innovation. As buyers sought out more options, including different varieties and processing methods, the need for more diverse green coffee auctions increased.

“Five years ago, the focus was on national, country-specific auctions. Now, we have regional auctions like Chicha Challenge in Peru, company-centric auctions like the Colombian Coffee Growers Federation, and private producer-run auctions,” says David Paparelli, the CEO of M-Cultivo, a coffee auction partner that improves market access through technology.

“Buyers increasingly show interest in the coffees and the producers, not just the country, organisation, or competition’s reputation.”

Coffee auctions are exclusive by nature, but the proliferation of private auctions is driven by a growing demand for rarity and prestige, attracting buyers from around the world who are willing to pay higher prices.

Record prices have become standard

Part of the appeal of coffee auctions is the premium prices they command. National competitions can fetch prices between US $10 to $100 per pound. However, as private auctions have become more popular, the prices that buyers are willing to pay continue to rise.

“The highest-priced coffee auctions are now private producer ones. Farmers who perform well at national competitions can take their best coffees to private auctions, or even set up their own,” David says. “A record-breaking lot five years ago had just broken the US $1,000/lb mark, but over the last 12 months, several auction lots have received bids of over US $10,000.

“The auction space has changed drastically, to the point where some of the most successful events are held outside of the ‘traditional’ country competition format.”

One of the most recent examples is the inaugural Dubai Coffee Auction, organised by M-Cultivo, which took place at the fourth World of Coffee Dubai trade show in February 2025. The auction included 16 exceptional lots from 11 producers across nine different countries, underscoring Dubai’s position as a global hub for specialty coffee trade.

“The Dubai Coffee Auction was the first event of its kind: a collection of some of the best producers in the world, sharing the auction stage at a live event with an auctioneer and the opportunity to connect with the buyers on the day,” David tells me. “These kinds of events bring excitement to the specialty coffee space, which helped us break several records in multiple countries.”

The highest bid was US $10,020/kg for a natural process Gesha from Finca Sophia in Panama, making it one of the most expensive coffees in the world. Additionally, La Llama from Los Rodriguez achieved a record price of US $350/kg for any previously auctioned Bolivian coffee. A Gesha Village Oma Natural also set a new record for Ethiopian coffee at US $1,100/kg, while a Kona SL 34 from Hawaii sold for US $910/kg, surpassing previous records by eight times.

Understanding the value of specialty coffee

Much like wine, whiskey, and tea, record prices help to reshape perceptions of coffee’s value and quality potential.

“ Record auction prices can help open the minds of coffee buyers and consumers about the value of coffee – not just monetary, but also in terms of its flavour profiles,” says Willem Boot, the CEO of Boot Coffee and the founder of Finca Sophia – which received the highest bid at the Dubai Coffee Auction – and La Mula Coffee in Panama.

“With the press coverage they generate, record prices help drive the idea that super specialty coffees should be treated like wine. Per bottle, wines can be expensive, driven by taste profile as well as rarity. High auction prices raise the top level of the market even more, driving quality differentiation in the marketplace.”

The impact of these record prices inevitably spreads beyond auctions.

“Breaking records helps anchor higher baseline prices for coffee,” David says. “Prior to the Dubai Coffee Auction, Hawaiian producers might have struggled to negotiate US $100/kg for their coffee, but they can now leverage record prices to raise the ceiling of what is possible.”

Facilitating connections

As private coffee auctions proliferate and diversify, attracting invested buyers willing to pay higher prices, producers have the chance to market their coffees more effectively.

“Record auction prices get people talking – in the media, in the industry, and even among consumers,” says Maria Olano, a senior trader at the Colombian Coffee Growers Federation (FNC). “A significant part of the value lies in the visibility and marketing that accompany those high numbers. When a coffee breaks a record, it generates buzz and brings attention not only to the auction but also to the producer behind it.”

By taking their “best” coffees to private auctions, producers can market these lots to esteemed buyers who are seeking exclusivity and prestige. Producers can also leverage the reputation of private auctions to command higher prices and access new markets where premiumisation is a key driver of growth.

“This kind of spotlight helps producers become known both in Colombia and internationally,” Maria adds. “Many of them are contacted by baristas who want to use their coffee in competitions like the World Barista Championship. They go to events, receive visitors, and send samples all over the world. It opens doors and builds real market access that extends beyond the auction itself.”

Following the success of the live Dubai Coffee Auction, larger quantities of all lots were available in an online international auction on 13 March. This edition raised over US $35,093 in total with more than 1,200 bids, connecting some of the world’s top producers with a wider network of international buyers.

Collaboration and trust become essential

But for these connections to develop into long-term partnerships, both producers and buyers need to be willing to invest in them.

“It has been M-Cultivo’s goal to facilitate trade between the best coffee producers and the best coffee buyers in the world,” David says. “The auctions and competitions are excellent marketing and promotional tools, but producers need to leverage the long-term benefits.”

Maria says that auctions are one of the few chances many producers get to show off their names, regions, and varieties, so they need to take advantage of these opportunities.

“Once a coffee makes it into an auction, producers can connect directly with buyers and roasters. The coffee actually gets exported and sold, and we make sure everyone knows who produced it and who’s buying it,” she says. “In some cases, these connections turn into long-term business relationships. We’ve seen producers and roasters working together for five or six years after first meeting through an auction.”

Auction platforms then need to create value for both buyers and sellers to support the longevity of working relationships.

“M-Cultivo supports the whole auction process. At the FNC, we trust the platform because it helps us keep everything transparent – from managing bids to tracking lots and making sure everyone involved has clear information,” Maria adds. “It also helps us reach a wider audience and plays a crucial role in spreading the word about the competition, connecting us with more potential buyers worldwide. That means increased visibility and improved market access for the producers who participate.”

Producers have the opportunity to build a global brand

As the private auction model becomes increasingly prevalent in the specialty coffee industry, more producers are discovering new opportunities to establish themselves in the global market.

“Private auctions and competitions offer producers something we often don’t have access to: a stage. Not just to sell but to be seen, heard, and understood for who we are and how we work,” says Max Perez, the founder of Finca La Hermosa and Gesha Forest Auction in Guatemala. “In a market where producers are frequently reduced to just a price per pound, these curated spaces remind everyone that coffee is not just a commodity; it’s a craft, a calling, and often, a family legacy.”

By selling their highest-scoring, best coffees through platforms that connect them directly to buyers, producers can build a brand around exceptional quality and meticulous farming practices.

“Auctions can showcase the actual value of coffee from the producers’ perspective. It can highlight an origin’s potential as well as a single producer,” says Diego Baraona, the manager of Los Pirineos in El Salvador and a fifth-generation coffee producer. “Better pay will result in increased motivation, as well as greater inspiration to continue working towards improved quality every year.”

Max agrees, saying: “Record prices create momentum. When one producer achieves recognition, it lifts the perception of quality for a region or even a country. That attention opens doors that often remain closed to small producers. It pushes buyers to ask deeper questions, to move beyond price and into purpose, which is where real transformation begins.”

Auction models play an integral role in the process

For this branding and marketing to be successful, auction platforms need to streamline the trade of green coffee.

“Producers have elevated themselves to the global stage, and they’re now running their own auctions that are breaking records,” David says. “But there has to be some follow-through after that to create a long-term business relationship, so you have to make the trade and delivery of these new and exciting coffees easier for global buyers.”

To support its mission of serving producers, roasters, and buyers worldwide, M-Cultivo will not host the Cup of Excellence, National Winners, or Alliance for Coffee Excellence private auctions this year. Instead, the platform will focus on a number of other auctions, including Best of Panama, the Dubai Coffee Auction, the Colombia Land of Diversity, Best of Rwanda, and Best of Ecuador.

“The industry doesn’t just need very high auction prices; we need to generate higher revenue and turnover for producers year after year to support their businesses in the long term,” David adds.

“This payment for the actual value of coffee will provide opportunities for producers to invest in infrastructure and other activities on the farm,” Diego says. “Working with M-Cultivo is a window into new markets; it brings very exciting opportunities for producers.”

Over the last few years, traditional coffee auction models have been reimagined, keeping up with innovation in the wider industry.

“Producers are hosting their own auctions; the Dubai Auction was a set of global producers: the industry needs to evolve and modernise,” David concludes. “We are increasingly more connected, and the barrier for producers to access buyers directly is disappearing.”

Enjoyed this? Then read our article on why virtual coffee auctions became so popular.

Photo credits: M-Cultivo

Perfect Daily Grind

Please note: M-Cultivo is a sponsor of Perfect Daily Grind.

Want to read more articles like this? Sign up for our newsletter!

Source link